eAlerts

Conveniently check-in on your SNBT accounts anywhere, anytime!

eAlerts

Conveniently check-in on your SNBT accounts anywhere, anytime!

Keeping tabs on your account has never been easier

Set up eAlerts through Bank Online or Mobile Banking and get real-time notifications through text or email. Why not take one more thing off your to do list? Let the eAlerts do the account check-in for you.

Get notified when your balance goes below (or above) your set amount OR set an alert to gives you your current account balance. Use to avoid overdrafts, maintain balance rewards, and know when to add extra funds.

Get an alert when a transaction type you specify occurs on your account, like a deposit or withdrawal or when money enters or leaves your account through a transfer.

Ding! That's the alert you'll get when your Debit Card is used at an ATM or for a transaction.

Receive an alert when a regular payment is made, an escrow payment was made, or your loan is past due. An easy way to keep an eye on your loan!

Set security alerts for when someone changes your contact information or tries to log into your account with the wrong credentials.

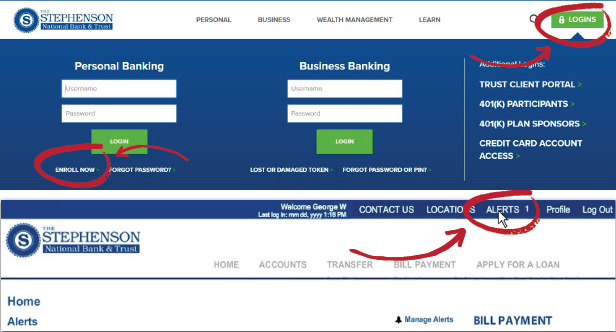

eAlert Setup

Getting started with eAlerts is easy!